montana sports betting tax rate

The state that reported the second-highest hold for the month of October was Montana 129 who has one of the most aggressive sports betting taxation policies in the. Steve Bullock signed HB 725 into law.

The States Most Likely To Legalize Sports Betting In 2022 Boardroom

Large gambling wins over 600 in the state of Montana may possibly attract an additional Federal Tax.

. Sports betting however is subject to a gambling winnings state tax of 1375 of the adjusted revenue winnings after tax has already been deducted Northeast Maine. The Illinois Gaming Board. An effective tax rate of 36 and a 10 million licensing.

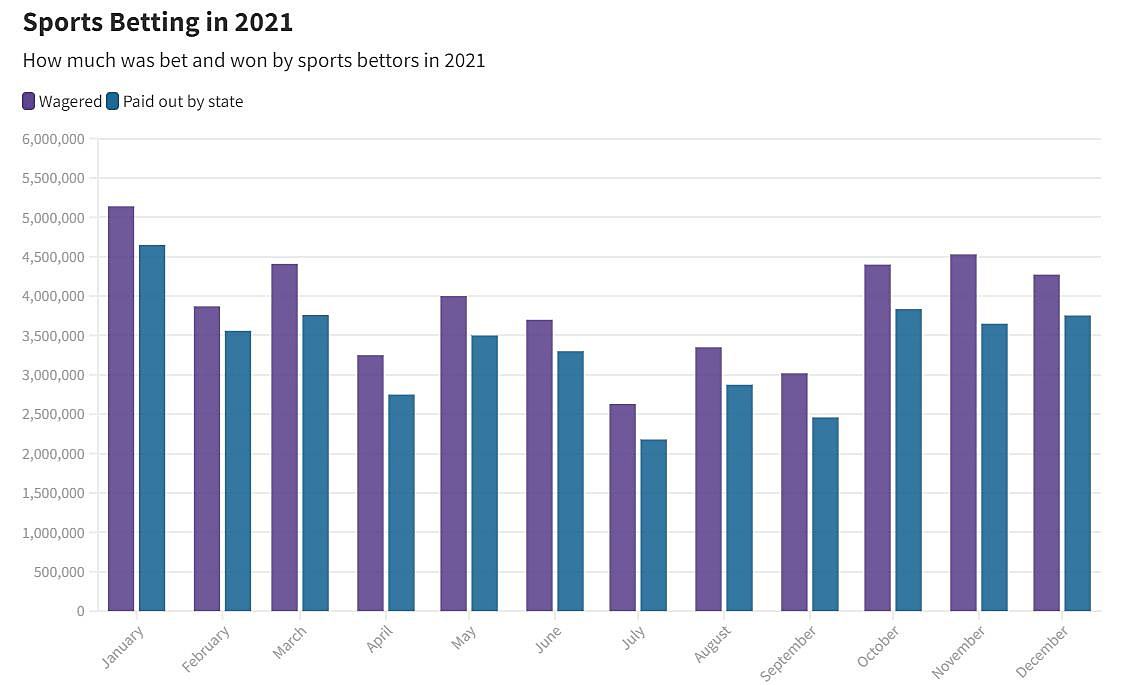

Run by the Montana Lottery sports betting has been in. Which were previously legal as an exemption to the Professional and Amateur Sports Protection Act. 31 rows Commonly sports betting operators have revenue known as hold of 5 percent of the handle.

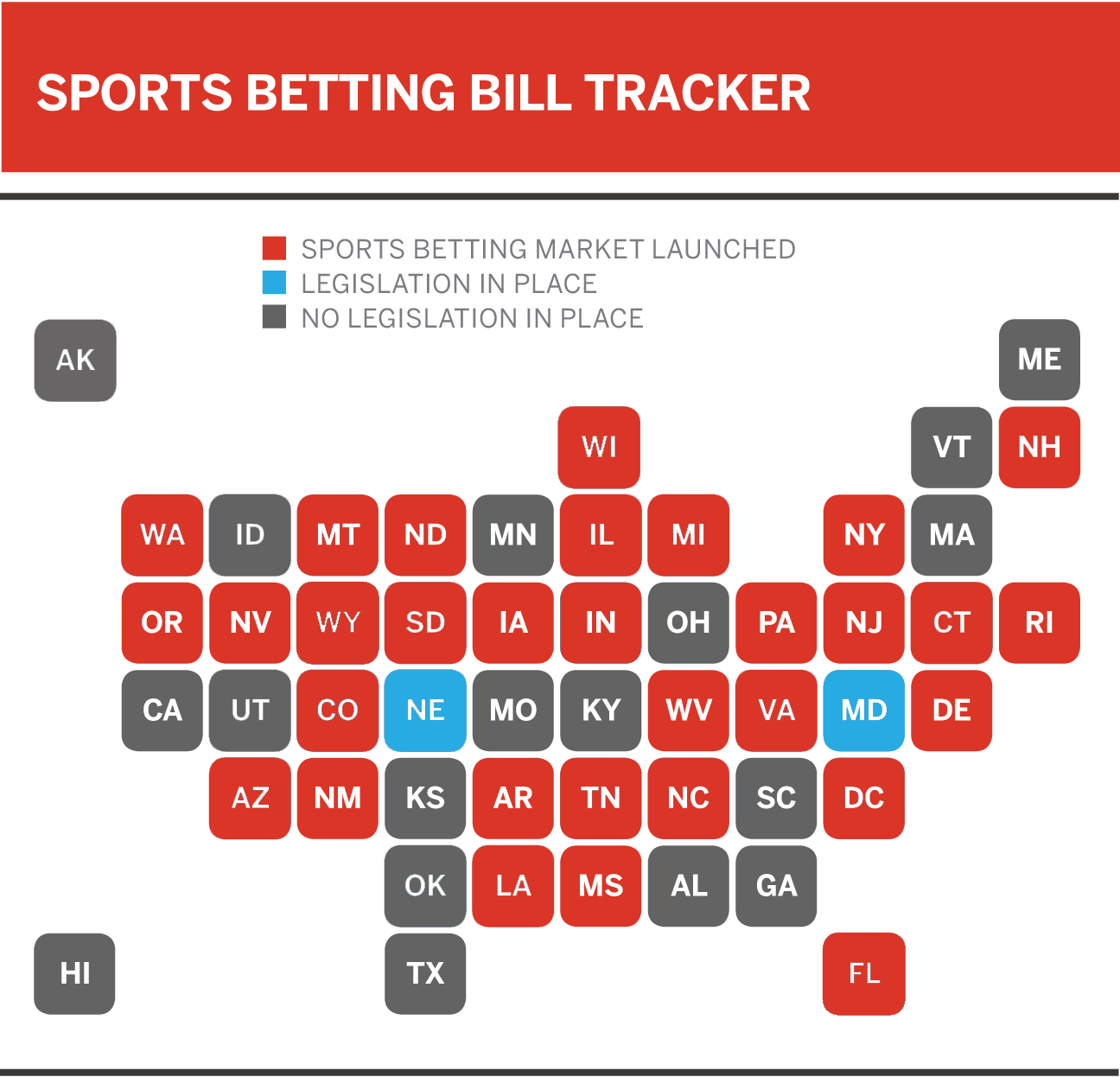

States have set rules on betting including rules on taxing bets in a variety of ways. When looking at the states who are already allowing legal sports betting the tax rate ranges from 675 to nearly 50. The other bill continued sports pools and pull tabs in barstaverns etc.

Intralot was awarded the contract without a public bidding. 2 A sports tab game seller licensed under 23-5-513 who sells sports tabs for use in a sports tab game shall collect from the purchaser at the time of sale a tax of 1 for each 100 sports tabs. Date Sports Betting Legalized.

Sports betting in Montana was regulated in 2019 when Gov. So lets now assess the Montana sports betting tax rate. This does not explicitly state sports betting but.

If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. What is the tax rate for Montana sports betting. Even though it was later to the party than the likes of New Jersey and Nevada Montanas entry to the US sports betting sector didnt.

Montana Sports Betting Tax Rates Montana has a 69 state tax on gambling winnings. In Maryland there is a gambling winnings tax rate of 875. The major gambling tax in the state is the Video Gambling Machine tax which is equal to 15 of VGM expenditures.

But when using the app the. 12 on gross revenue. In-state betting on college sports.

Open an online project and start working in the most developed betting market in Europe. One leader Senate President Mark Blasdel believes a. 2022 Montana sports betting.

How States Tax Sports Betting Winnings. Best Montana Sports Betting Sites on this page have an online sports betting licence from the Montana Lottery ensuring that they are regularly tested for fairness security and a high level of. Facilities are required to withhold 24 of your earnings for.

The exceptions to the rule are Delaware New Hampshire and Rhode Island which. Montana Gambling Control Division takes gambling crimes very seriously. Since the legal sports betting expansion in 2018 the amount of sports betting revenue has increased dramatically.

However a figure of between 85 and 10 is expected. The tax rate for the HB 725 bill has yet to be confirmed. How did legal sports betting in Montana become a reality.

The lowest rate is 2 whereas the highest is just under 6 at 575. Montana sport betting totals Montana market snapshot. Since the inception of legal sports betting in 2018 the Garden State has collected 1695.

Tax rate on sportsbook operators. How States Tax Sports Betting Winnings. Information on local and federal gambling laws legal MT sportsbooks sports betting sites and MT mobile betting apps.

Use this page to report suspicious Gambling Liquor or Tobacco related activities in Montana. In this game the bookmaker expects the most probable total runs in the game to be 105. SB 690 Overseen By.

This is in line with the national trends where the majority of states have opted for lower rates. Taxes are withheld if the winnings minus the wager are more than 5000 and are at least 300 times as large as the amount of the wager. The only legal option for sports betting in the state is through the lottery and the platform operated by Intralot.

Bets made at sports betting terminals have a 250 maximum. June 2019 Online Licensing Began. - Federal taxes are currently withheld at.

Delaware Montana See Double Digit Sports Betting Holds For October

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

Maine Sports Betting Is Sports Betting Legal In Maine

Arizona Sports Betting Best Arizona Sportsbook Offers May 2022

How Sports Betting Has Increased Predatory Gambling Across The U S Baptist Life Kentuckytoday Com

Ohio Sports Betting Legislation Update Crabbe Brown James Llp

As Ohio Gets Ready Legalized Sports Betting Grows

Why The Sports Betting World Hates Vegas Dave Sports Betting Moving To Las Vegas Betting

Montana Sports Betting Guide To Best Mt Sportsbooks

Montana Sports Betting Is Legal Sports Betting Available In Montana

Americans Bet 125b On Sports In 4 Years Since Legalization Seattle Sports

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Montana Sports Bettors Wagered 46 Million In 2021 But Did They Win Missoula Current

States Where Sports Betting Is Legalized And Possible New Ones In 2022

Sports Wagering Bond Spells Opportunity For Insurance Agents

The United States Of Sports Betting Where All 50 States Stand On Legalization

Sports Betting Is Now Legal In Several States Many Others Are Watching From The Sidelines